DISCOVER NORAH MINING

Where Nigerian heritage meets global mining standards. Registered with the Corporate Affairs Commission and deeply rooted in our indigenous ownership, we stand as a testament to the transformative power of responsible mining. Our strategic presence from Ode-Remo’s rich lands to Lagos’s corporate pulse is a narrative of growth, commitment, and excellence. At Norah Mining Limited, we are not just extracting minerals; we are crafting the building blocks of Nigeria’s industrial future.

eND-TO-END MINING EXPERTISE

Exploration

Leveraging advanced geoscience to discover untapped mineral potential while ensuring responsible extraction practices. Our focus remains on sustainability, environmental care, and community well-being.

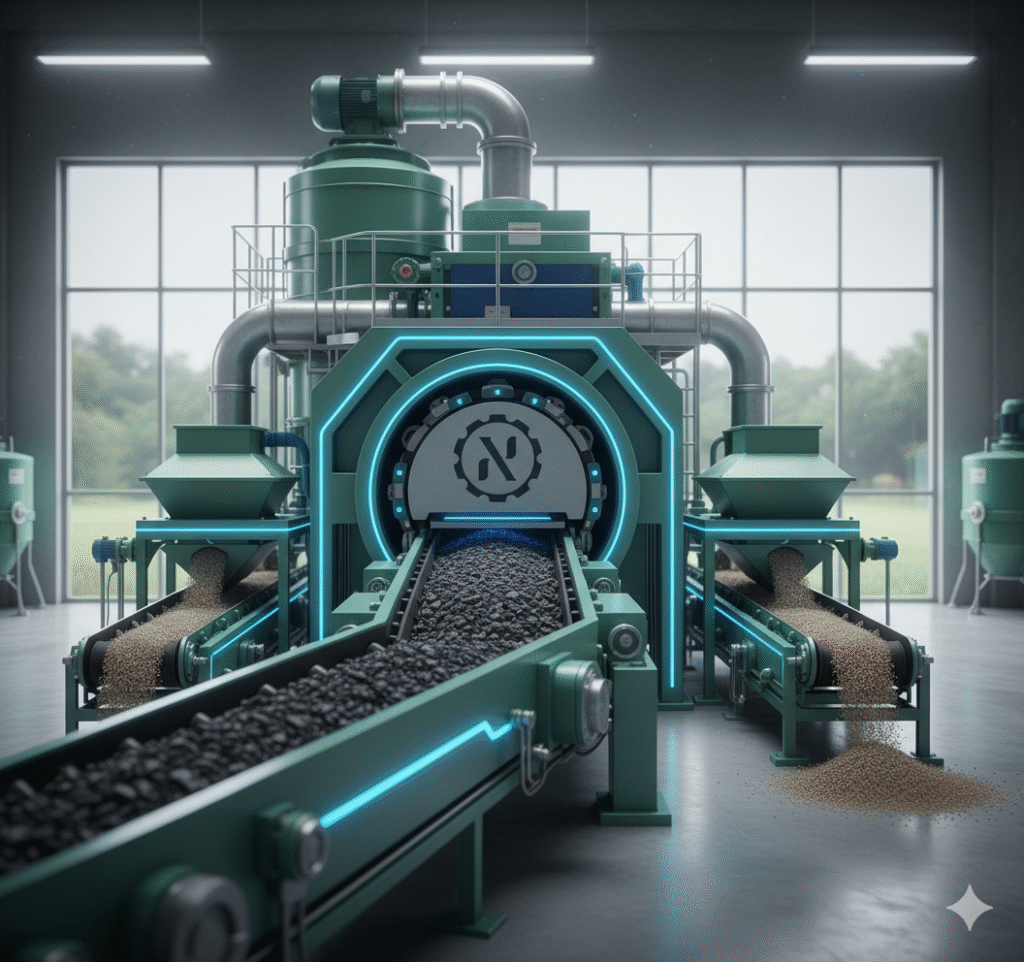

Beneficiation

Enhancing the quality of ore through advanced and innovative processing techniques designed to maximize efficiency, improve extraction outcomes, and deliver higher-grade materials for industrial and commercial use.

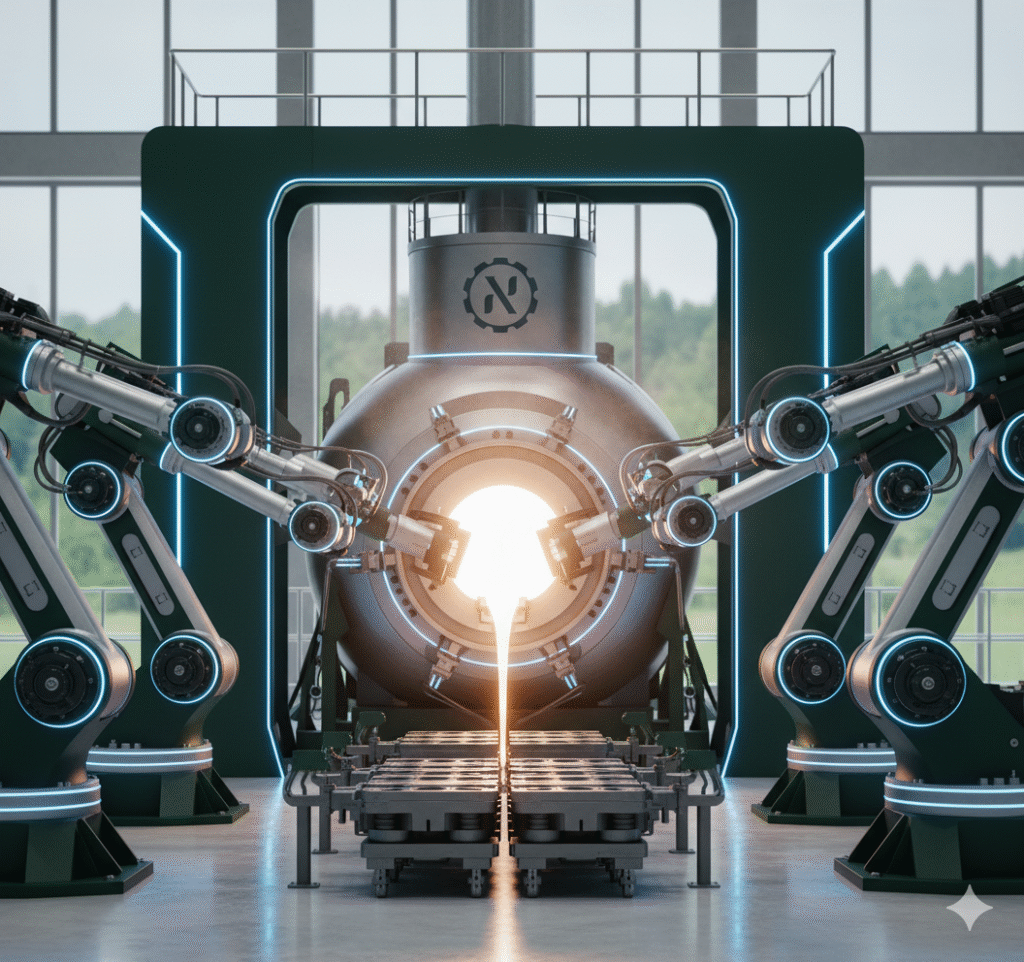

Refining

Refining metals with unmatched precision and meticulous attention to detail, ensuring superior quality and performance for a wide range of applications. Our process combines advanced techniques, delivering metals that meet the highest standards.

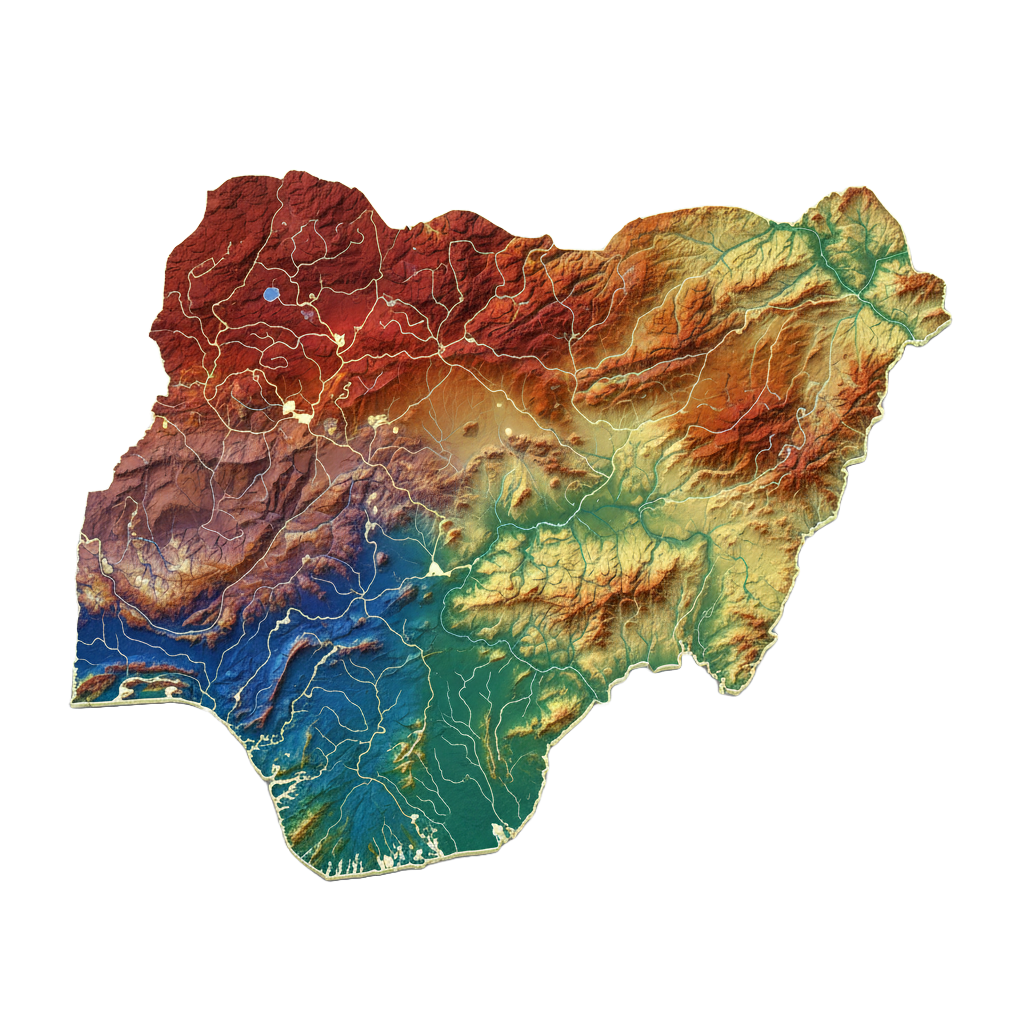

DiSCOVER OUR RESERVES

84.4 Hectares

84.54 Hectares

8407.6 Hectares

POWERING THE FUTURE OF GREEN ENERGY

Norah’s Lithium reserves and recently completed processing plant position it at the cusp of the green energy revolution. Estimates suggest Lithium demand could triple or even quadruple by 2030, reaching over 3.8 million tonnes, driven primarily by the surge in electric vehicle (EV) battery demand and broader clean energy initiatives.

JOIN THE WAVE

Norah Mining Ltd is on track to IPO on the Australian Securities Exchange in 2027, but you do not have to wait…

Introducing $Norah Token

A digital security representing a direct, legally enforceable claim on your lithium reserves and production. The project is structured through a bankruptcy-remote Special Purpose Vehicle (SPV) to protect investors and the underlying assets.

Smart-Contract automated Quarterly Revenue Obligations (QROs): 6% of plant revenues, distributed in stablecoins.